How much can I spend during my retirement?

I often preach the importance of estimating how much money you can safely withdraw from your retirement savings to ensure they don't run out. For people who decide to invest their savings and make periodic withdrawals to cover their living expenses, I prefer that you use what's known as a "systematic withdrawal" method to calculate your retirement paycheck. This is a much better approach than simply "winging it" and withdrawing from your savings whatever amounts you need to meet your current living expenses.

But to come up with an educated guess at how much you can safely withdraw from savings, you'll need to make a few key assumptions, whether you're using an online retirement calculator yourself or working with a financial advisor. The most important assumptions you need to make are:

- How long you -- and your spouse or partner, if applicable -- will live, or how long you'll need retirement income

- The rate of return you'll earn on your savings, considering income and appreciation

- The rate of inflation you'll experience on your living expenses

While there can be other assumptions you may need to make, these are three of the most critical and most common.

If you're using systematic withdrawals to generate your retirement paycheck, it's best to periodically adjust your withdrawal amounts to reflect events that have happened during your retirement. Part of the adjustment process includes revisiting these assumptions throughout your retirement to make sure they still represent your best estimate.

Let's take a closer look at these three assumptions.

How long will you live?

One way to estimate your expected length of retirement is to use an online life expectancy calculator, such as www.livingto100.com or www.bluezones.com, that will estimate your life expectancy given your current lifestyle and family history. The Society of Actuaries also maintains a simple life expectancy calculator on its website that doesn't ask questions about your family history or lifestyle.

Just to be safe, I'd add five or 10 years to the result -- that way, you'll be less likely to run out of money should you be fortunate to live a long time. You'll also want to estimate the life expectancy of your spouse or partner, if applicable.

A simpler approach would simply be to assume you'll need retirement income until your 95th birthday or your spouse's 95th birthday, whichever is later. However, this assumption won't make sense as you approach your 90s -- if you've made it to your late 80s, the odds are increasing that you'll live beyond age 95. You may want to start adjusting this assumption if you make it into your 80s.

What rate of return will you earn on your savings?

Your assumption regarding the rate of return on your retirement savings should reflect your asset allocation -- how much you're invested in stocks, bonds, cash and other investments. You can build in some conservatism here to make sure you don't outlive your retirement savings. For a balanced portfolio invested in stocks and bonds, I'd assume an annual rate of 5 or 6 percent.

If you end up earning more than your assumed rate of return, then you can incorporate this bonus when you recalculate your withdrawal rate each year. For example, your savings may have grown at rates much higher than 5 or 6 percent during 2013 due to favorable returns in the stock market, and you could have increased your withdrawal amount for 2014 to reflect that fortunate outcome.

What's your rate of inflation?

Regarding inflation, an annual rate of 3 or 4 percent seems reasonable to me for the overall economy. However, there's evidence that many people actually spend less money as they age, because they reduce their spending on household goods, travel and hobbies. If you want to take this likelihood into account, you could assume a 2 percent rate of inflation, or even lower if you really think you'll be spending less as you age.

Some people fear that recent government policies may cause high inflation in the future. If you really believe that will happen, then it makes sense to protect yourself by assuming much higher rates of inflation than mentioned above, which would reduce the amount that you would withdraw in the coming year.

A test run

My last post discussed a simple online calculator you can use to calculate how much you can withdraw from your savings each year and how much you can adjust your withdrawal amount each year to reflect changes in your circumstances.

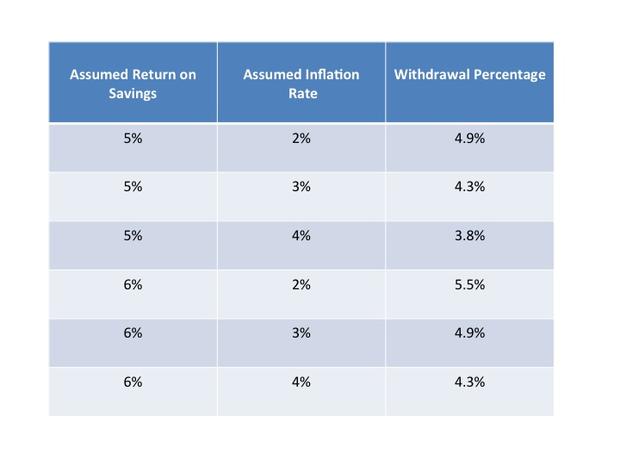

I took this program for a test spin, using a retirement period of 30 years for somebody retiring at age 65. I calculated the initial annual withdrawal rate for a few different investment return and inflation scenarios. The initial annual withdrawal rate is the dollar amount of your withdrawals divided by your amount of retirement savings. The results are shown below:

The above withdrawal rates are in the ballpark of the well-known "safe" withdrawal rate of 4 percent, or in the 3 to 5 percent range that was explored in a recent study.

Many analysts focus on the real rate of return, which is your total rate of return minus the inflation rate. Note that the above table shows real rates ranging from 1 to 4 percent. If you assume higher real rates of return, you'll produce higher current withdrawal amounts.

You may feel more comfortable using a more sophisticated tool, such as a so-called Monte Carlo analysis. One of my favorites is on the T. Rowe Price website -- it produces withdrawal percentages similar to amounts in the above table (except for the highest percentages).

By incorporating different scenarios into your calculations, you can learn a lot about how your withdrawal amount will change due to the key factors you need to take into account -- your life expectancy, rate of return on your investments and the inflation rate.

In the process, you'll realize there's no magic formula or number that's guaranteed to produce a retirement income that lasts the rest of your life and covers all your living expenses. That's why I like being on the safe side: I use conservative assumptions and will adjust the withdrawal amount throughout my retirement to reflect what circumstances have actually happened in my life that affect my retirement paycheck.

Estimating the right amount to withdraw from savings in retirement is part art, part science, but making initial, educated assumptions -- and revisiting these numbers periodically -- can help you calculate the numbers that work best for you.