How millennials and "summer Fridays" are weighing on wages

This economic cycle has featured record stock market rallies and record corporate profits. And yet, by the metric most important to many Americans, it's been a disappointment.

I'm talking about the lack of wage growth. Running around 2.5 percent annually, it's well off the rate of nearly 4 percent in 2008.

One possible explanation, according to economists at Bank of America Merrill Lynch, is that non-salary "lifestyle" benefits and perks are becoming increasingly important.

Younger workers may be more interested in flexible hours and wellness programs. And businesses like labor-cost flexibility.

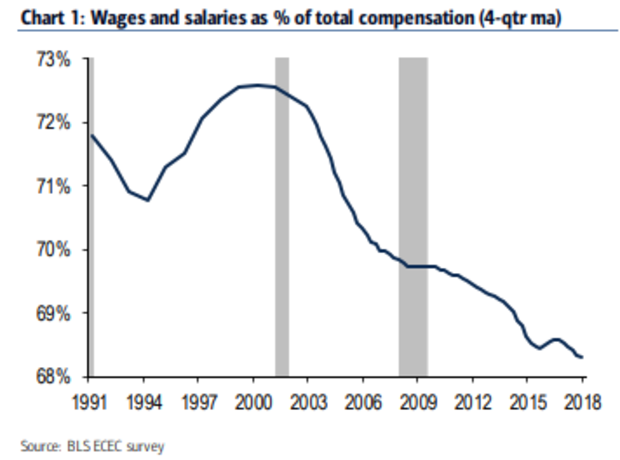

In fact, wages and salaries as a percentage of total compensation has been in steady decline falling from a high near 72.5 percent in 2000 to just over 68 percent now. Admittedly, the shift doesn't seem like much. But when the difference between tepid and rip-roaring wage inflation is only a couple of percentage points per year, it adds up.

Especially when one compounds the wage gains forgone in exchange for flex hours over a ten-year period. Assuming a $55,000 starting salary, the difference between a two percent and a four percent annual raise at the end of ten years is $65,730 vs. $78,282, or a difference of $12,552.

At the same time, according to Bureau of Labor Statistics data, the percentage of employees with access to wellness programs has increased from 34 percent in 2010 to near 43 percent last year. These are things like physical fitness programs, stress management courses and nutrition education among other benefits.

The data is sparse -- how you do quantify the availability en masse of ping pong tables and free food and other modern perks? -- but what is available suggests a meaningful shift away from a focus on salaries.

Even when times are good, businesses seem to be sharing the wealth via one-time bonus payments rather than permanent raises, protecting themselves from locking in higher expenses when another recession hits.

Data collected by Aon Hewitt shows that bonus payments accounted for nearly 13 percent of the rise in total labor costs last year compared with just 2.9 percent for salary raises. (The rest is driven by things like tepid labor productivity and rising healthcare costs.)

It seems the workers are happily accepting this trade off.

Almost 9 out of 10 people said they'd consider choosing a lower-paying job over a higher-paying one if the former offered better health insurance and a more flexible work schedule, according to a survey of 2,000 people by content marketing firm FRACTL.

And a 2015 survey by the Employee Benefit Research Institute and Greenwald & Associate found that Millennials were twice as likely than Baby Boomers to report paid time off as the most important work benefit.

Michelle Meyer and her team at Bank of America Merrill Lynch note the "shift towards benefits and non-monetary compensation and away from wages" is yet another factor suppressing wage growth, alongside familiar headwinds like the deep scars of the financial crisis and automation.

As a result, she said, "we may have a lower peak for wages growth in this cycle relative to prior recoveries."